Get the right experience for you. Please select your location and investor type.

Insights

Articles, research and reports

Author

Strategy

Topic

Type

P&I Interview: Delivering returns through stewardship

Sashi Reddy and Sujaya Desai speak to Pensions & Investments about the importance of stewardship, and how we look for management teams who have the intention and ability to leave businesses in much better shape than they found them in.

Why stewardship matters

Prioritising long-term growth over short-term gains takes confidence and vision from high-quality management. Great stewardship through long-term decision making benefits businesses in myriad ways but it doesn’t manifest the same way in every company.

A collaborative approach to engagement: Tackling Plastic Waste in India

Every year we produce around 400 million tonnes of plastic waste worldwide. Of the seven billion tonnes of waste amassed to date, less than 10% of this has been recycled. The remaining 90% is buried in landfills, makes its way overseas to be burnt, or is lost into the environment where it can live for up to 400 years.

Global Emerging Markets Sustainability strategies update - April 2023

Jack Nelson provides an update on the Global Emerging Market Sustainability strategies. In the Q&A session, Jack comments on the strategy’s exposure to India and discusses potential opportunities the team are seeing in China.

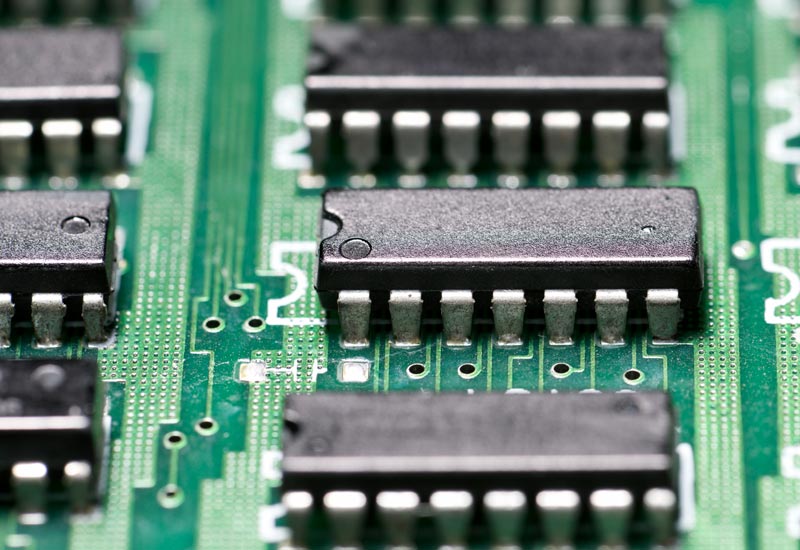

Beyond Due Diligence: A multi-stakeholder approach to responsible mineral sourcing

An insight into our collaborative engagement on conflict minerals in the semiconductor supply chain.

Sustainable Investing: Don’t forget the humans

Climate change is one of our greatest threats. At Stewart Investors we consider it a key investment risk, and an investment opportunity.

Scope 3: Everything, everywhere, all at once

Why Scope 3 emissions hide as much as they reveal, and what investors can do about it.

P&I ESG Investing Conference

We are excited to sponsor the P&I ESG Investing Conference taking place in Chicago this April.

P&I Interview: ESG Investing

Pablo Berrutti, Senior Investment Specialist speaks to Joshua Scott of P&I.

Tech and Healthcare: Is correlation risk what it seems?

Senior Investment Analyst Oliver Campbell discusses how we approach correlation risk.

Our thoughts on the FCA’s proposed Sustainable Disclosure Requirements (SDR)

In October 2022 the UK Financial Conduct Authority (FCA) published its much anticipated consultation on proposed Sustainability Disclosure Requirements, investment labels and restrictions on the use of sustainability-related terms in product naming and marketing.

Climate solutions update

In mid-2022, Project Drawdown announced 11 new solutions to their collection related to ocean resources, food production, methane management, and materials manufacturing and use.

Why India: Investing in the Indian subcontinent

The Indian subcontinent has been a fantastic investment destination over the last few decades. Investment returns in the subcontinent have been primarily driven by India since she liberalised her economy in 1991.

Why India: A favourable macro environment

India is a region which demands patience but rewards patient investors through steady compounding of returns.

Why accounting choices matter

Commuters on the London Underground would be familiar with the warning to “mind the gap”. The investment industry is in dire need of a similar warning but with an extra A – “Mind the GAAP”.

i3 interview: Sustainability myths in emerging markets

Jack Nelson speaks to the Investment Innovation Institute. In this insightful fireside chat, they discuss some of the common misconceptions about investing in emerging markets.

Panel discussion: Active ownership

During Good Money Week in the UK, Senior Investment Analyst Chris McGoldrick sat down with Asset TV for a panel on active ownership.

Responsible Investment Leader 2022

We are thrilled that for the second year running, Stewart Investors has been recognised as a Responsible Investment Leader 2022 by the Responsible Investment Association Australasia (RIAA).

Tackling climate change in emerging markets

As the human effects of climate change continue to intensify around the world, asset owners and managers are rightly grappling with their responsibilities to help avoid catastrophe.

Spotlight on sustainability: WEG

Portfolio Manager, Sujaya Desai, discusses energy efficient electrical motor manufacturer, WEG.

Trip report: Europe

On a recent trip to Europe, Hanna Ranstrand visited various companies who are building their businesses through acquisitions. Here, Hanna discusses these companies in more detail.

Spotlight on sustainability: Watsco

Sashi Reddy discusses Watsco, the largest distributor of HVACR (heating, ventilation, air conditioning and refrigeration) products in North America.

The importance of diversity

How do the Stewart Investors team seek to address diversity? Sashi Reddy discusses the investment team’s approach, and why fostering diversity of thought is not just important but crucial in implementing the team’s investment philosophy for the long term.

Climate change statement

We launched our first sustainable investment fund in 2005. At that time we were convinced all companies would need to adjust to operating in an increasingly carbon-constrained world, and more companies would need to develop solutions to make economies less carbon intensive. Our conviction has never waned, nor has the urgency of the carbon-reduction challenge.

Climate Report: The race to zero

Welcome to our climate report. In the report we share a baseline of our climate change-related risks, opportunities and impacts, from which our progress towards zero-carbon portfolios and operations can be assessed in the years ahead.

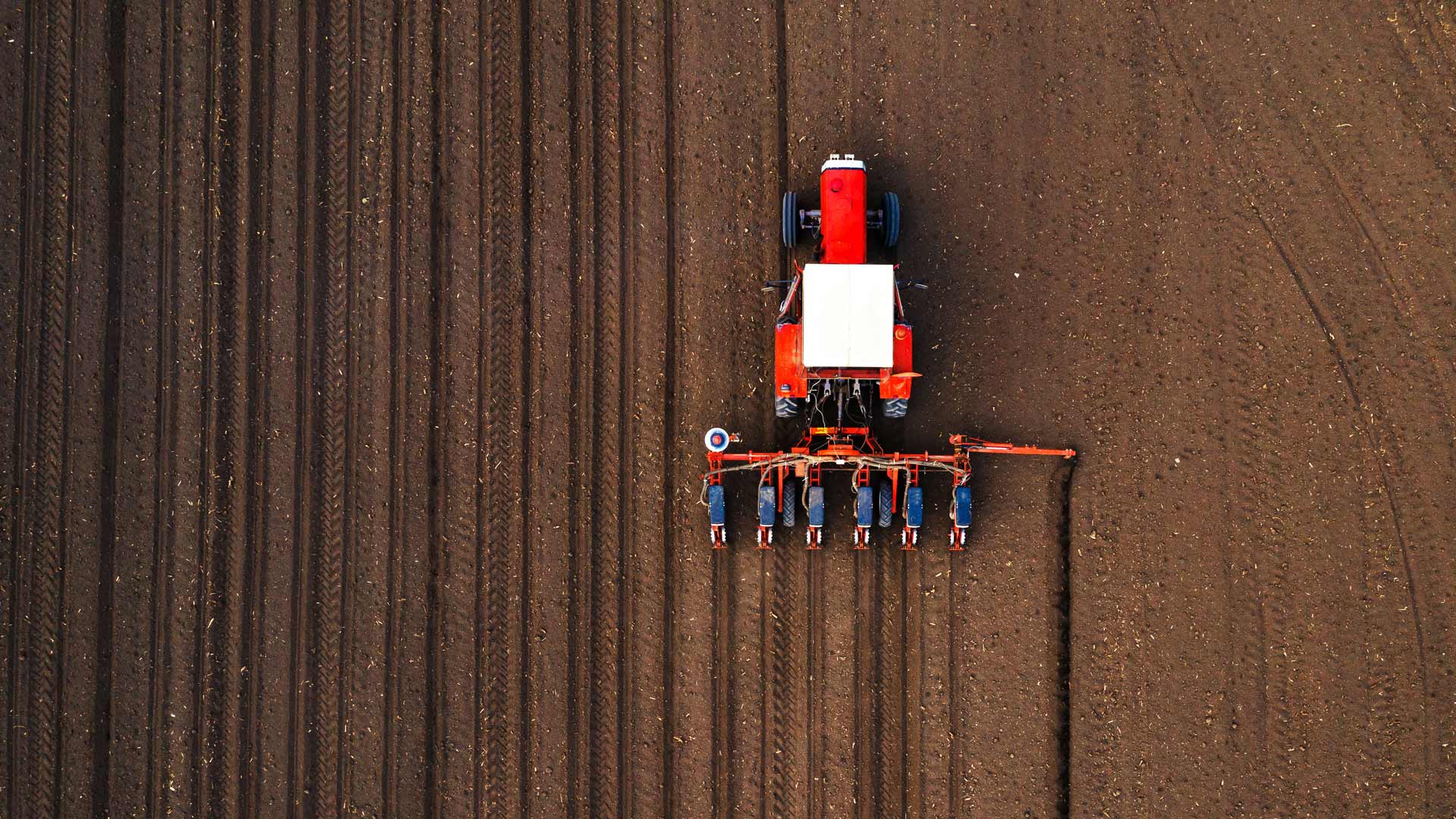

Investment and sourcing through smallholder supply chains

Finding there was a lack of information on smallholder farmer supply chains and their environmental impact, we commissioned research with NIRAS-LTS International to learn more.

Podcast: A sustainable conversation

Pablo Berrutti, Senior Investment Specialist at Stewart Investors, speaks to Wouter Klijn of the [i3] Investment Innovation Institute in Australia to discuss the likelihood of fossil fuel-based companies making the transition to low carbon business models and pose the question whether companies’ quick retreat from Russia during the invasion of Ukraine is a vindication for ESG.

The problem with ESG scores

Some ESG data can be useful in certain circumstances, but can an over reliance on simplistic ESG scores be a dangerous strategy?

Trip Report: US

The emergence of trends that will likely shape the next decade, including cloud computing, automation, connectivity and artifical intelligence (AI), has created some appealing honeypots for investors to dip their paws into. These companies are often well positioned in the face of broad sustainability tailwinds and characterised by steady growth streams, so one can understand the allure.

Proxy Voting Policy and Guidelines

We believe judgement is a better guide to voting than a rules-based approach. Our voting policy is based on a parsimonious set of principles and key considerations that in our judgement are likely to be applicable to all companies in the vast majority of circumstances.

Fund Manager of the Year – Sustainable Investing, Morningstar Australia

We are delighted that Stewart Investors has won the inaugural Fund Manager of the Year – Sustainable Investing category at the 2022 Morningstar Australia Awards.

Diversity statement - what have we done so far?

Diversity is an integral part of sustainable development and has always been important to us as investors, employers and as members of society.

How big is big enough?

Today’s technology giants may have many admirable qualities, but should we question their ongoing contribution to sustainable development?

Company Interview: Watsco Inc

Heating and air conditioning usage account for a large percentage of the energy consumed in the average American home. By installing energy-efficient HVACR systems, Watsco, Inc. are assisting home owners to reduce their environmental footprint and tackle climate change.

Exploring outside the lines

Our interactive tool, Portfolio Explorer is helping us share how impactful companies are contributing to sustainable investments.

Our Human Development Pillars

Struggling to clearly articulate the world of ESG investing? You’re not alone. Learn more about our sustainable development framework. Jack Nelson explains.

What makes us different?

Stewart Investors' portfolios differ from any other comparative index. Our active share is often above 80 or 90%. Watch the full video to learn more.

The Power of Story

In a recent essay, Santa Fe economist Brian Arthur challenges economists to describe the world in more than algebraic terms. He believes they should extend their vocabulary (and minds) to include verbs, alongside their highly prized nouns, to allow the underlying processes, context and organic nature of complex systems to be described in full technicolour.

Company Interview: HDFC

CEO and VP Keki Mistry discusses the history of HDFC Limited and how its services are evolving to consider the growing risks of climate change.

Our position on harmful and controversial products and services

We invest in the shares of high quality companies that are well positioned to contribute to, and benefit from, sustainable development.

Is Europe an exciting place to invest?

Europe can be a very exciting investment destination, if you take the time to seek out its treasures.

Diversity statement

Diversity is an integral part of sustainable development and is important to us as investors, employers and as members of society.

Ten years in emerging markets

If the last ten years investing in emerging markets has taught us anything it is that in the long run, quality wins.

Why does stewardship matter in emerging markets?

Emerging markets have long been understood as geographies of uncertainty. Are good company stewards the answer?

Making a difference through science and innovation

Sashi Reddy and David Gait of Stewart Investors speak to G. V. Prasad, Chairperson and Managing Director at Dr. Reddy’s an Indian pharmaceutical company.

Is Europe leading the way in sustainable business?

Europe is seldom considered the most exciting place to invest. This is mainly because European index returns – a proxy for average market returns – have been modest over most time frames. But Europe offers some excellent investment opportunities for active investors willing to seek out its treasures.

The magic of microbes

WHO has predicted up to 10 million deaths from multi-resistant bacteria by 2050. Could changes in animal farming practices prevent this?

Good Old-Fashioned

Due to its consistent focus on the future, "old-fashioned" investing has stood the test of time.

Avoiding the perils and pitfalls for high impact healthcare investment

Investing in healthcare companies seems an obvious choice for sustainable investors. After all, any company that helps cure disease, and improve health and wellbeing must be making a positive contribution to sustainable development.

Emerging markets’ new generation of tech firms

Over the last decade, the role and prominence of technology companies in emerging markets has increased markedly. Emerging markets economies have proven themselves capable of producing truly world-leading tech firms. And as smartphone penetration has surged, the positive impact of technology on daily life in emerging markets has been very significant.

Paying a fair corporate tax rate matters

When we come across a company proactively trying to minimise their tax payments, it is a red flag for us.

Reasons to invest in Europe

Even investors who get excited about investing in European equities can understand why many people don’t. A great many savers think their investment options are limited to the average market return provided by an index-tracking fund. And the average returns of European index investments look very average, over almost any time period.

The importance of culture

While a strong culture can sustain a business, a toxic culture can break it. As sustainable investors, it’s always important to understand how the culture of companies we invest in can impact how they treat their employees and customers and, ultimately, influence the wider world.

Indian Subcontinent: the decade ahead

The Strategy did well in 2020, thanks in part to the generosity of central banks globally, while the real economy tried to shake off a pandemic. However, we believe that the real opportunity for investors in the subcontinent should be in the decade ahead. We are optimistic for two reasons.

The sustainability positioning of an imperfect giant

In early December 2020, activists from Greenpeace deposited a big sculpture of Nestlé’s* logo, made entirely of plastic waste from Nestlé’s products, in front of its headquarters, alongside a banner with a powerful simple message - ‘Stop feeding the world with plastic’.

Learning from success: CAMFED

Education is not freely available to everyone - and in many parts of the world girls are the first to be excluded from it. Girls are the first to drop out of school, and the first to be failed by the system, facing the perils of early marriage, early pregnancy, and abuse. Without the choice to write their own futures, their endless potential is wasted.

Why do Payable Days matter?

‘Payable Days’ is the number of days a company takes to pay its suppliers. Investors often learn in ‘Finance 101’ courses that the longer a company takes to pay its suppliers the stronger its bargaining power is with them. Consequently, this is considered as key evidence of a strong franchise. We beg to differ.

Regulatory developments in sustainable finance

2020 saw regulatory developments in sustainable finance reach new levels globally, but particularly in Europe. These developments, combined with a global pandemic, unprecedented wildfires, and a renewed focus on social movements like Black Lives Matter, put sustainable finance under the spotlight more than ever.

Diversity: An indicator of distinctive cultures

One of the key tenets of our investment philosophy has long been a focus on the cultures and people behind businesses. We believe that franchises that are successful over the long term are built on the backs of unique cultures that have the wherewithal to resist short-term pressure in favour of nurturing a sustainable business over decades, have the ability to think diversely about the opportunities ahead and the risks they might face, and the operational focus to deliver on their strategies year after year.

Asia: Playing the Long Game

Time-horizons matter. In a world beset by an ever-expanding list of developmental, environmental and economic challenges, a long-term mind-set is crucial if companies are to not only survive, but contribute and benefit from the necessary changes required over the coming decades.

Sustainable development in emerging markets

Why sustainable development and returns can be achieved in emerging markets.

Company contributions to sustainable human development

Since our first sustainable development-focused strategy launched in 2005, human development has been a key focus area given our long history of investing in Asia Pacific and emerging markets.

Moving the dial on diversity and inclusion at Halma

Sujaya Desai and Pablo Berrutti discuss how to approach to diversity and inclusion with Halma.

The Future of Food and Sustainable Agriculture

Agricultural techniques have changed dramatically over the last 50 years, particularly in more developed nations.

Through the Looking Glass

In the sequel to Lewis Carroll’s ‘Alice in Wonderland’, Alice climbs ‘Through the Looking-Glass’ and finds another fantastical world, absent of reason and where everything is reversed. This crisis of logic is all too evident when in investing in Asia Pacific.

Why climate change measures do not make sense, and how we can fix them

If asked to list climate change solutions, many of us would start with renewable energy. It is obviously a key one given the use of fossil fuels for energy is the largest contributor to greenhouse gas emissions globally.

Statement on racism and racial diversity

We recognise the existence of inequality and institutional racism across the world – we share the horror felt by so many as we have witnessed events that highlight the inequality, prejudice and sheer injustice faced by members of the black community the world over.

Rainbow washing the SDGs away

The Sustainable Development Goals (SDGs) have been broadly embraced by financial institutions. This is a positive move, and timely too.

European Sustainable Finance Consultation

Stewart Investors wrote to the Directorate-General for Financial Stability, Financial Services and Capital Markets Union in response to aspects of the Renewed Sustainable Finance Strategy.

Active versus passive

Growing investor concerns about climate and societal crises have contributed to the burgeoning demand for ‘sustainable investment’ funds that take into consideration environmental, social and governance (ESG) factors.

Companies supporting the fight against COVID-19

The COVID-19 pandemic is having a devastating personal and economic impact worldwide and there is an urgent need for governments, companies and individuals to play their part in helping to slow the spread, protect the vulnerable and minimise the human and economic toll.

Trip report: India

The ongoing crises making their way through the Indian financial system are indicative of the years of irrational exuberance in the decade prior.

Implementing the Sustainable Development Goal 12

The United Nations Sustainable Development Goals (SDGs) provide a clear and vital framework around which investors and the broader business community can unite to achieve a collective goal of cleaner business practices. One goal which many investors and businesses are placing emphasis on is SDG 12: Responsible Consumption and Production.

SEC Letter: Proxy Voting

We have made a submission to the US Securities and Exchange Commission (SEC) on proposed changes to proxy advisors and shareholder resolutions.

Challenging the greenwash

Our philosophy at Stewart Investors is to invest in ‘quality companies’ and our process for identifying them has incorporated a rigorous evaluation of ESG for over three decades. However, our analysis of ESG has never stood in isolation, and must be taken together with assessment of management, franchise and financials.

Diversity update

In 2019, we commissioned a research project with the University of Technology (UTS) in Sydney to compile a set of recruitment and retention policies that have been implemented across geographies, industries, and organisations and can be tied to tangible improvements in diversity outcomes. This report, entitled Improving Gender Diversity, was completed a few months ago. It lays out a list of 13 tools that have been successfully used to recruit and retain women in organisations.

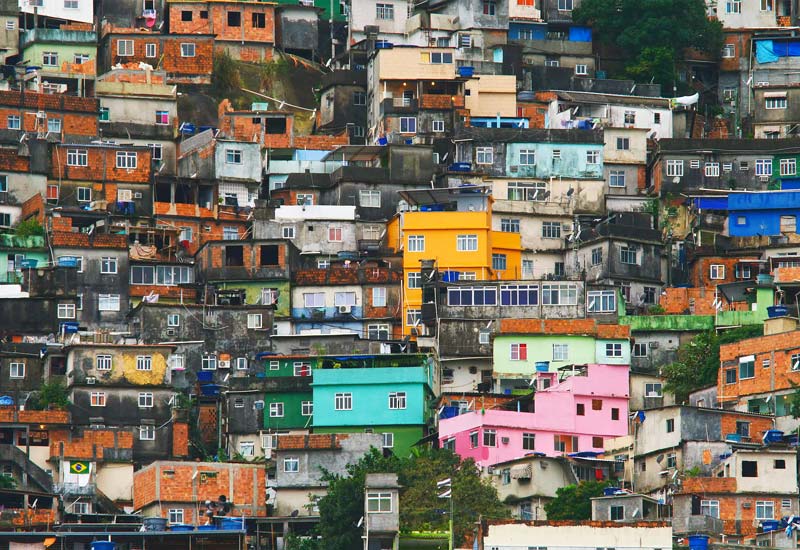

Investing in Emerging Markets

Emerging markets are usually seen as a risky asset class. News headlines in recent years of street protests, rapid currency devaluations and corporate governance blow-ups have done little to dispel these impressions.

Tackling plastic pellet loss throughout supply chains

As it is just over 12 months since we instigated the plastic pellet loss investor initiative, we thought we would take the opportunity to provide you with an update and summary of progress since our last update in March 2019.

Trip report: Brazil

Recent history in Brazil has seen a push towards identifying and weeding out the linkages between corporate and political networks that have intertwined over decades to breed a culture of impunity.

Loyalty shares will improve long-term stewardship goals

Pablo Berrutti discusses long-term stewardship goals in the Financial Times.

Small is beautiful

This rule of thumb was coined in order to combat a common challenge facing teams trying to solve complex problems. In pursuits like investing, there is a tendency to increase the number of people providing input to the point that the team gets bloated and functions less efficiently.

Amazon fires, Global Deforestation and what we are doing about it

In this featured article we review the role of companies and business risks of this global issue.

Quality & Patience

Today, asset owners have an unprecedented range of options of where to invest and an even greater number of well-argued reasons for why each of these will be the most attractive home for their capital. Aggressive, untested monetary policy has helped fuel years of above-average equity returns, encouraging many of those who run these strategies to predict handsome returns for investors.

Press Article: Australian Financial Review

Three tech stocks that won't make you queasy Written by Patrick Commins, Australian Financial Review, 28 March 2018

Our Hippocratic oath in action

Our Hippocratic oath is something we all hold dearly and have all signed. It underpins our investment philosophy, which is based on identifying quality stewards of strong franchises with good long-term prospects.

Should your clients quit sugar?

By April 2018, 31 countries will have imposed a tax on sugar to tackle the worldwide epidemic of obesity.

How we select companies

We have often been asked how we narrow down a universe of 15,000 Asian and Emerging Markets companies to a portfolio of approximately 50. It’s a good question, particularly as now that we invest globally, giving us an investible universe of 65,000 companies, the challenge has become even starker.

Dual Share Class Blundering

We used to send letters to companies and stock exchanges extolling the virtues of single share classes, tag along-rights and ‘one share, one vote’. Today, we actively seek out companies with dual share classes. What has changed?

Family companies are the real attraction of investing in Asia

Why is Asia still regarded as a separate asset class by investors? At first glance, it looks like an artificial construct, made up of 15 countries with very little in common, other than crude proximity on a global map.

Sustainable palm oil?

Recent forest fires across Malaysia and Indonesia cast a haze over many parts of Southeast Asia.

Tax Approaches

We consider the tax rates paid by companies that we might invest in on behalf of our clients important because it impacts our assessment of Quality of Management, Franchise and Financials.

The Sharing Economy

Sharing resources has gone on for as long as humans have been living in tribes. But without the enabling role of the internet or mobile devices it is hard work in a large complex society with a myriad of goods and services. The internet is now helping to solve this problem.

Green Bookkeeping

In 2010, Puma pioneered a new form of corporate reporting. The German sportswear company produced an environmental profit and loss account, which estimated the company and its supply chain to have caused €145m of environmental damage that year, relative to €202m of net profit.

Does Fund Management have a social purpose?

The stock market and bond market have their origins in the financial revolution of the late 17th century. The stock market developed to provide funds for overseas trading companies, like the English East India Company, while the bond market funded the state, mostly raising funds for waging of war.

The Circular Economy

US clothing retailer Patagonia famously encouraged consumers not to buy their jackets in 2011...

Alice in Financeland

At first glance, there is little about the current financial system that makes sense. The more one looks, the less sense it makes. In theory the financial sector is supposed to support the long-term growth of the real economy. In practice, it has become so detached from the real world that it is more akin to a fantasy land, inhabited by a growing number of peculiar characters undertaking nonsensical tasks. Lewis Carroll’s Alice would be very much at home.

The Plastics Paradox

Plastic is wonderful stuff. It is lightweight, so less carbon intensive to move around. It is durable, mouldable and less energy intensive to make than aluminium or glass. It helps reduce food waste and decreases the risk of food contamination.

Opinion piece on Unilever

Investors are underestimating Unilever’s sustainability success story.

Trip report: Japan

The below image is a sign from a packed subway line en route to the bullet train at Shinagawa Station. A sign that initially amused but then began to hold more power as a metaphor as the trip went on. In most other countries, a sign highlighting the pain that comes from getting trapped in a train door would be enough to deter passengers from trying their luck with some automatic doors.

Trip report: India and Taiwan

“Dabur before self”, responded Mr Duggal, the CEO of Dabur, when we asked what he is looking for in his successor. Stewardship is central to our investment philosophy at Stewart Investors, and the importance of the quality of incoming leadership cannot be understated. The risk, however, is that we arrive at conclusions too quickly or use the wrong measuring tape.

Copyright © 2023 Stewart Investors.